The world’s hunger for data has never been more voracious, creating a cascade of demand that is reshaping the foundational infrastructure of the digital economy. At the epicenter of this seismic shift lies the 400G optical transceiver market, which has consistently defied conservative forecasts, charting an aggressive expansion trajectory that few anticipated just a few years ago. This powerful growth is not merely a transient trend; rather, it reflects a fundamental confluence of technological maturation, unprecedented application demand, and compelling economic advantages for hyperscale operators. For those relying on high-speed connectivity—from cloud architects to data center engineers—understanding the velocity and substance of this expansion is crucial for future-proofing network designs. Indeed, the momentum within the 400G optical transceiver market is driven by core forces, primarily the exponential scaling of artificial intelligence (AI), the unrelenting growth of hyperscale cloud environments, and the critical need for improved power efficiency in modern data communication.

The Unprecedented Surge in Data Traffic: The Core Catalyst

The primary factor propelling the 400G optical transceiver market is the sheer volume and velocity of data traffic now traversing global networks. Traditional forecasts often underestimated the symbiotic relationship between cloud computing, mobile usage, and emerging technologies, leading to overly cautious projections for network hardware upgrades. Today, a new generation of applications requires staggering bandwidth, pushing existing 100G infrastructure to its breaking point and necessitating immediate migration to higher speeds.

Hyperscale Data Centers and the Cloud Juggernaut

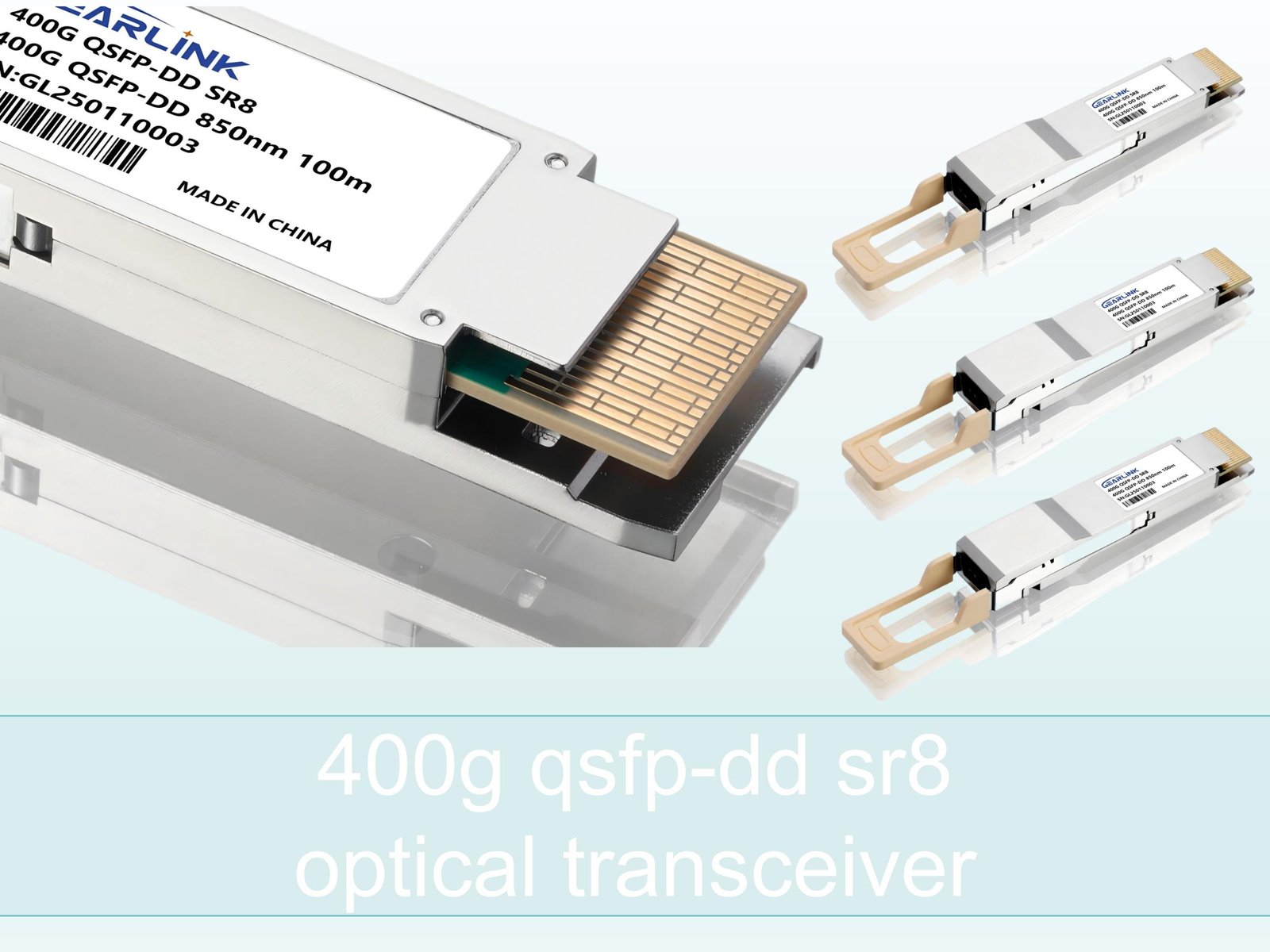

Hyperscale data centers, operated by the world’s largest cloud service providers (CSPs), serve as the engine room of the modern internet. These massive facilities must accommodate millions of virtual machines, supporting everything from streaming video to global enterprise services. As these CSPs continuously expand their footprint and offer increasingly complex services, the need for higher port density and faster switch-to-switch connectivity becomes paramount. To maximize the utility of their multi-million dollar switching silicon, data center operators actively demand 400G transceivers, specifically QSFP-DD and OSFP form factors, to achieve necessary intra-data center speeds. This migration fundamentally shifts the market from legacy lower-speed optics to 400G modules, dramatically increasing the overall volume and deployment scale within the 400G optical transceiver market. Furthermore, the constant refresh cycle inherent in the cloud business—typically every three to five years—ensures that new, higher-speed optics are rapidly adopted, accelerating the market’s pace.

The AI/ML and Generative AI Revolution

Perhaps the single most impactful driver that exceeded market expectations is the explosion of Artificial Intelligence (AI), particularly the rise of deep learning and Generative AI models. Training these massive neural networks requires immense computational power, distributed across thousands of tightly interconnected Graphics Processing Units (GPUs). This demanding environment creates an unparalleled need for high-speed, low-latency communication between compute nodes. Unlike general data center traffic, AI clusters require a fabric that can sustain peak bandwidth across all links simultaneously, often utilizing technologies like Remote Direct Memory Access (RDMA) over Ethernet. For the inter-GPU communication within a server rack and, more critically, between racks, 400G transceivers are the current standard of necessity, providing the crucial bandwidth density required to prevent bottlenecks and ensure training efficiency. The sheer scale of planned AI build-outs across every major cloud provider guarantees sustained, exponential growth for the 400G optical transceiver market well into the future.

Technological Readiness and Standardization

The swift market expansion would be impossible without the simultaneous maturation and standardization of key optical technologies. While demand set the stage, technological readiness provided the necessary, cost-effective product solutions.

Maturation of Essential Technologies: PAM4 and DSP

The ability to transmit 400 Gigabits per second over four electrical lanes, each running at 100 Gbps, relies heavily on Pulse Amplitude Modulation 4-level (PAM4) signaling and sophisticated Digital Signal Processing (DSP) chips. PAM4 effectively doubles the bit rate per symbol compared to traditional Non-Return-to-Zero (NRZ) signaling, making 400G a practical reality within the compact QSFP-DD and OSFP form factors. Early challenges related to signal integrity and power consumption in the DSP have largely been overcome. Today’s advanced CMOS technology allows for smaller, more power-efficient DSPs that can reliably manage the complex encoding and decoding required for PAM4 across various fiber types and distances. This technological perfection significantly lowered the barrier to entry and increased the mass manufacturability of 400G modules, directly fueling the market’s accelerated trajectory.

The Crucial Role of Standardization and Interoperability

Industry bodies like the Ethernet Alliance (IEEE) and the Optical Internetworking Forum (OIF) played a critical role by rapidly defining specifications for 400G deployment. Standardization ensures that transceivers from different manufacturers can flawlessly interoperate within the same network. This lack of vendor lock-in is vital for large-scale data center operators, allowing them to optimize procurement and maintain supply chain flexibility. Specifications like 400GBASE-DR4 (for short reach, parallel single-mode fiber) and 400GBASE-FR4/LR4 (for longer reach, duplex single-mode fiber) created a unified product ecosystem. The quick, decisive agreement on these standards removed uncertainty for network architects, enabling rapid design and deployment cycles and proving a significant factor in the unexpectedly rapid growth of the 400G optical transceiver market.

Economic and Deployment Advantages of 400G

400GBASE-SR4 OSFP 850nm 50m DOM MPO-12/APC MMF Optical Transceiver Module

Price range: NT$499 through NT$898

400GBASE-FR4 QSFP112 PAM4 1310nm 2km DOM Duplex LC/UPC SMF Optical Transceiver Module

NT$750400GBASE-SR4 QSFP112 PAM4 850nm 50m DOM MPO-12/APC MMF Optical Transceiver Module

Price range: NT$699 through NT$799

Beyond raw speed, the compelling economics of 400G over earlier technologies like 100G provides a powerful business case that incentivizes accelerated adoption, particularly among budget-conscious yet performance-driven users.

Superior Power Efficiency and Operational Expenditure

In modern data centers, power consumption is often the single most significant operational expenditure (OpEx) and a major constraint on scalability. The 400G transceiver offers a dramatic improvement in power efficiency when measured by the critical metric of watts-per-bit. While a 400G module consumes more absolute power than a 100G module, the efficiency gain is substantial. A single 400G transceiver often utilizes less than three times the power of a 100G module to deliver four times the bandwidth. This improved efficiency minimizes cooling requirements and reduces electricity costs over the lifetime of the network. The resulting long-term economic benefit motivates rapid infrastructure upgrades, making the immediate transition to 400G a financially astute move for hyperscale operators. This focus on long-term sustainability and cost reduction provides a powerful, consistent driver for the 400G optical transceiver market.

Density and Scalability in the Rack

The adoption of the QSFP-DD (Quad Small Form-factor Pluggable Double Density) and OSFP (Octal Small Form-factor Pluggable) form factors is central to 400G’s density advantage. These form factors effectively double the density of the previous generation 100G QSFP28, allowing a single switch to support significantly more ports. For example, a standard 1U rack-mount switch can support 32 ports of 400G, totaling 12.8 Terabits per second (Tbps) of throughput. This incredible density is vital for consolidating switching fabrics, reducing the overall footprint, and simplifying complex cabling schemes within a server cluster. The ability to dramatically increase bandwidth without expanding physical rack space is an invaluable asset in capital-intensive data center real estate, directly contributing to the accelerated and high-volume demand for 400G optics.

Key Application Segments Driving High-Volume Adoption

The speed of adoption is fundamentally linked to how and where these high-speed modules are deployed. The acceleration of the 400G optical transceiver market is clearly visible across two primary application domains within the optical network landscape.

Inter-Data Center Connectivity (DCI)

The connections between geographically dispersed data centers, known as Data Center Interconnect (DCI), are essential for service resiliency, load balancing, and disaster recovery. As data centers scale and cloud services become global, the capacity of these links must grow exponentially. 400G coherent optics, often utilizing advanced technologies like 400ZR and 400G-ZR+, offer simplified, high-density solutions for metro and regional DCI links. These modules can plug directly into routing and switching equipment, eliminating the need for bulky, separate transport systems, significantly lowering capital expenditure (CapEx) and complexity. This simplification of the network stack has made 400G DCI solutions extremely attractive, pushing the long-haul segment of the 400G optical transceiver market into overdrive.

In-Data Center/Switching Fabric

The backbone of modern data center architecture is the spine-and-leaf network topology. This architecture demands massive, highly redundant bandwidth between the leaf switches (connecting to the servers) and the spine switches (the core aggregation layer). 400G transceivers are the workhorse in this environment, primarily utilizing the 400GBASE-DR4 standard for short-reach, single-mode fiber links. The ability to use fewer, faster fibers to connect the entire fabric simplifies cable management, reduces installation time, and provides a clear path for future 800G and 1.6T upgrades. The widespread, non-negotiable requirement for high-speed fabric interconnects across every new cloud and enterprise data center construction solidifies the foundation for the sustained growth seen in the 400G optical transceiver market.

Challenges and the Path to 800G and Beyond

While the growth has been impressive, the industry must navigate certain challenges to sustain this momentum. Supply chain volatility, the increasing complexity of manufacturing integrated optics, and the continuous pressure on pricing remain constant factors. However, the market’s focus is already shifting to the next generation. The immediate and overwhelming success of 400G has acted as a proof point, validating the architecture and setting the stage for the imminent transition to 800G and 1.6T optics. The lessons learned in optimizing power, density, and standardization for 400G are now being applied to these future platforms, suggesting that the pace of adoption for the next-generation modules will be even faster. The rapid development and standardization of 800G, often leveraging two 400G lanes, demonstrates a continuous and aggressive commitment to scaling bandwidth, cementing 400G’s role as a necessary, transformative stepping stone in the optical communications history.

Conclusion

The accelerated expansion of the 400G optical transceiver market is a compelling story of demand meeting innovation. It is a market fueled by the relentless demands of AI and hyperscale cloud services, underpinned by the maturity of PAM4 and DSP technologies, and validated by the superior power and density economics it offers. For optical product users, the message is clear: 400G is the current anchor technology defining the standard of performance and efficiency. Investing in 400G solutions today provides the most robust foundation for scalability, power management, and future-proofing connectivity needs, ensuring networks are ready to tackle the data demands of tomorrow.

Frequently Asked Questions (FAQ)

Q1: What is the main difference between QSFP-DD and OSFP form factors in 400G?

A: Both QSFP-DD (Quad Small Form-factor Pluggable Double Density) and OSFP (Octal Small Form-factor Pluggable) are key form factors in the 400G optical transceiver market, designed to support 400 Gbps. The primary difference is size and power capacity. The QSFP-DD is backward-compatible with older QSFP modules, making it slightly more compact and easier to integrate into existing infrastructures. The OSFP is slightly larger, which allows it to handle higher power consumption, often favored for more demanding applications or future higher-speed modules like 800G, where thermal dissipation is critical.

Q2: How does 400G help reduce the total cost of ownership (TCO) for a data center?

A: 400G reduces TCO primarily through two mechanisms: Power Efficiency and Cabling Reduction. By utilizing the improved watts-per-bit efficiency, data centers spend less on electricity and cooling over the life of the equipment. Furthermore, consolidating four 100G links into a single 400G link dramatically reduces the number of physical cables, patch panels, and ports required, simplifying management, installation, and maintenance costs.

Q3: Will 400G be replaced quickly by 800G modules?

A: While 800G modules are beginning to enter the market, 400G is expected to remain the dominant, high-volume workhorse for several years. 800G will initially target the most demanding inter-switch and AI cluster applications in hyperscale environments. The transition follows a pattern: the previous generation (100G) remains prevalent in edge and access networks, while the current generation (400G) handles the core, and the next generation (800G) targets the cutting-edge. 400G has established a massive installed base and excellent cost efficiency, ensuring its dominance in general switching fabrics for the foreseeable future.