The insatiable global appetite for instant data access, coupled with the unprecedented computational requirements of Artificial Intelligence (AI) and Machine Learning (ML), is fundamentally reshaping network infrastructure. As data centers rapidly migrate from 400 Gigabit Ethernet (400GbE) to the next frontier of 800 Gigabit Ethernet (800GbE), the 800G optical transceiver market is positioned for explosive growth. This transition is not merely an incremental speed increase; it represents a revolutionary shift in component density, power efficiency, and the underlying technology required to support massive, interconnected GPU clusters. Understanding the dynamics of the 800G optical transceiver market is crucial for data center operators, cloud service providers, and network equipment manufacturers who must strategize their infrastructure investments years in advance. Therefore, the essential question for industry stakeholders is: How rapidly will the specialized demands of AI accelerate the adoption curve, and what key technological milestones will define the future of the 800G optical transceiver market? We will meticulously analyze the technological drivers, examine the prevailing form factors, and articulate the key competitive factors shaping this critical segment of the optical industry.

The Technological Leap: Drivers Shaping the 800G Optical Transceiver Market

The ability to achieve 800GbE is primarily dependent on advancing two core technological areas: electrical signaling speed and optical integration.

The Foundation of 100G/Lane Signaling

The foundation of the 800G optical transceiver market is the standardization of 100 Gigabits per second (Gbps) per electrical lane. While earlier 400G modules relied on 50G/lane technology, the shift to 100G/lane enables 800G to be achieved by utilizing eight lanes (8x100G) or even four lanes (4x200G) of parallel data transmission. This shift is critical because it maintains a high degree of compatibility with existing switch architectures and leverages the industry’s investment in co-packaged optics (CPO) and high-speed CMOS technology. This doubling of the per-lane speed places significant stress on the module’s thermal management and signal integrity but is indispensable for delivering 800G in a compact pluggable form factor. The success of the 800G optical transceiver market hinges on the cost-effective mass production of components capable of sustaining this high electrical performance.

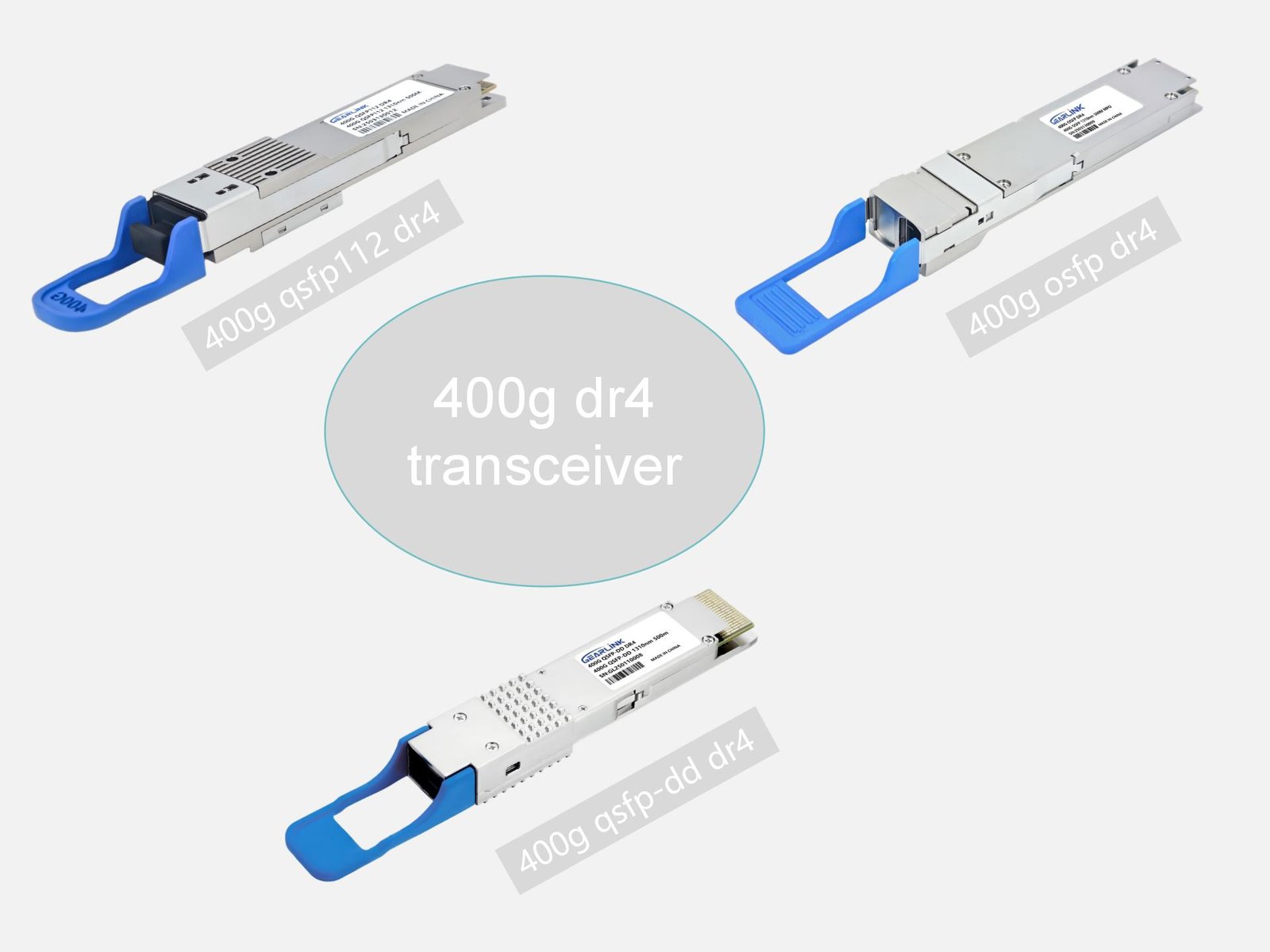

Form Factor Evolution: OSFP and QSFP-DD

The 800G optical transceiver market is currently defined by competition between two primary pluggable form factors: OSFP (Octal Small Form-factor Pluggable) and QSFP-DD (Quad Small Form-factor Pluggable Double Density). Both are designed to support the increased density and thermal requirements of 800G. The OSFP is generally slightly larger, offering potentially better thermal performance and a clearer upgrade path to 1.6T, while the QSFP-DD retains high port density and stronger backward compatibility with 400G and 200G switches. Network architects choose between these based on their specific port density goals, cooling constraints, and long-term upgrade strategies. The evolution of cooling technologies within these form factors, such as the adoption of liquid-cooled rack interfaces, is a major trend influencing the future trajectory of the 800G optical transceiver market.

Market Dynamics: AI Clusters and Hyperscale Adoption

The demand for 800G is largely concentrated among the world’s largest cloud service providers (CSPs) and specialized AI enterprises building massive, interconnected GPU superclusters.

The Accelerator of AI and ML Workloads

The rapid scale-up of AI training models, such as those used for large language models (LLMs), requires thousands of GPUs to communicate simultaneously with ultra-low latency. This inter-GPU traffic, often traversing Clos network architectures, dictates the need for immense, non-blocking bandwidth. 800G optical transceivers are therefore deployed to connect the spine and leaf switches within these clusters, providing the necessary throughput for efficient parameter sharing and model synchronization. The high-volume, performance-driven demand from these AI clusters is the single largest factor fueling the current expansion of the 800G optical transceiver market. This demand tends to favor specific module types, such as 800G SR8 (Short Reach, 8 channels), which uses Multi-Mode Fiber (MMF) and is optimized for the links within a single data hall.

Hyperscale Data Center Rollouts

Beyond AI, the core 800G optical transceiver market is driven by the general refresh cycle of hyperscale data centers. As 400G becomes the standard for general-purpose server links, 800G is quickly becoming the standard for inter-rack and aggregation layers. These applications require various distances, creating segmented demand for different optical technologies:

- Short Reach (SR8): For links within 100 meters (using MMF).

- Medium Reach (DR8/FR4): For links up to 500 meters or 2 kilometers (using Single-Mode Fiber, SMF).

- Long Reach (LR8/ZR): For Data Center Interconnect (DCI) links over 10 kilometers.

The volume requirements from these hyperscale deployments solidify the 800G optical transceiver market as a multi-billion dollar segment, driving significant investment in manufacturing automation and component efficiency.

Competitive Factors: Price, Power, and Co-Packaged Optics

As the 800G optical transceiver market matures, competition focuses increasingly on cost efficiency, power consumption metrics, and the move toward highly integrated solutions.

800GBASE 2 x DR4/DR8 OSFP PAM4 1310nm 500m DOM Dual MPO-12/APC SMF Optical Transceiver Module

Price range: NT$1,699 through NT$1,768

The Power Efficiency Race

Power consumption is arguably the most critical metric for data center operators today. High-speed transceivers generate significant heat, directly impacting cooling costs and rack power density. Manufacturers in the 800G optical transceiver market are in a constant race to lower the power required per gigabit. Innovations in silicon photonics (SiPh) and advanced DSP (Digital Signal Processor) architectures are key to achieving this. Modules that offer superior power efficiency—for instance, those that can deliver 800G while consuming less than 16 watts—hold a decisive competitive advantage in large tenders, making power efficiency a central focus of product development.

The Rise of Co-Packaged Optics (CPO)

Looking slightly ahead, Co-Packaged Optics (CPO) represents the next evolution beyond the pluggable 800G optical transceiver market. CPO involves integrating the optical engines directly into the same package as the switch ASIC (Application-Specific Integrated Circuit). This radically shortens the electrical traces, drastically reducing power consumption and increasing signal integrity, which becomes necessary for 1.6T and beyond. While CPO is currently in its early deployment stages, the development and standardization work occurring within the 800G optical transceiver market are laying the critical groundwork for this integrated future, ensuring seamless transition pathways for equipment manufacturers.

Conclusion

The 800G optical transceiver market is defined by a confluence of explosive demand from AI clusters and the continuous need for hyperscale data center bandwidth expansion. Driven by the technological mastery of 100G/lane signaling and the competitive evolution between the OSFP and QSFP-DD form factors, this market segment is one of the most dynamic in the optical networking industry. For manufacturers and users, success depends on a strategic focus on power efficiency, cost optimization, and the flexibility to deploy a mix of short-reach and medium-reach technologies. The rapid adoption rate, spurred by the insatiable requirements of AI, confirms that 800G is not just an upgrade but the essential foundation for the next decade of high-speed global computing.

Frequently Asked Questions (FAQ)

Q1: What is the main reason AI development is accelerating the 800G optical transceiver market?

A: AI training requires massive, ultra-low latency data exchange between thousands of interconnected GPUs. 800G optical transceivers provide the necessary huge, non-blocking bandwidth to connect the spine and leaf switches within these dense GPU clusters efficiently.

Q2: What are the two main form factors competing in the 800G optical transceiver market?

A: The two main form factors are OSFP (Octal Small Form-factor Pluggable) and QSFP-DD (Quad Small Form-factor Pluggable Double Density). Both are designed to handle the 800G bandwidth and thermal demands.

Q3: How does silicon photonics (SiPh) impact the future of the 800G optical transceiver market?

A: SiPh is a key technology for reducing the size and power consumption of 800G transceivers. By integrating multiple optical components onto a silicon chip, SiPh drives the necessary cost and power efficiencies required for mass deployment in hyperscale data centers.